Superintelligent stock research

Use our research reports to get a complete picture of a company’s fundamentals.

Recent research reports

Get an overview and then dive deep.

We give you the big picture, then let you dive deep into the details. Our AI research engine is trained to find companies with great products, great management, and the ability to maintain that greatness for years to come. We let you know if the share price is fair so you can build a portfolio destined for growth.

Understand

the fine print.

We research everything from financial results and annual reports to information on lawsuits and corporate misbehavior. We digest all of this information into easy-to-read reports, highlighting the facts that matter most to an investor.

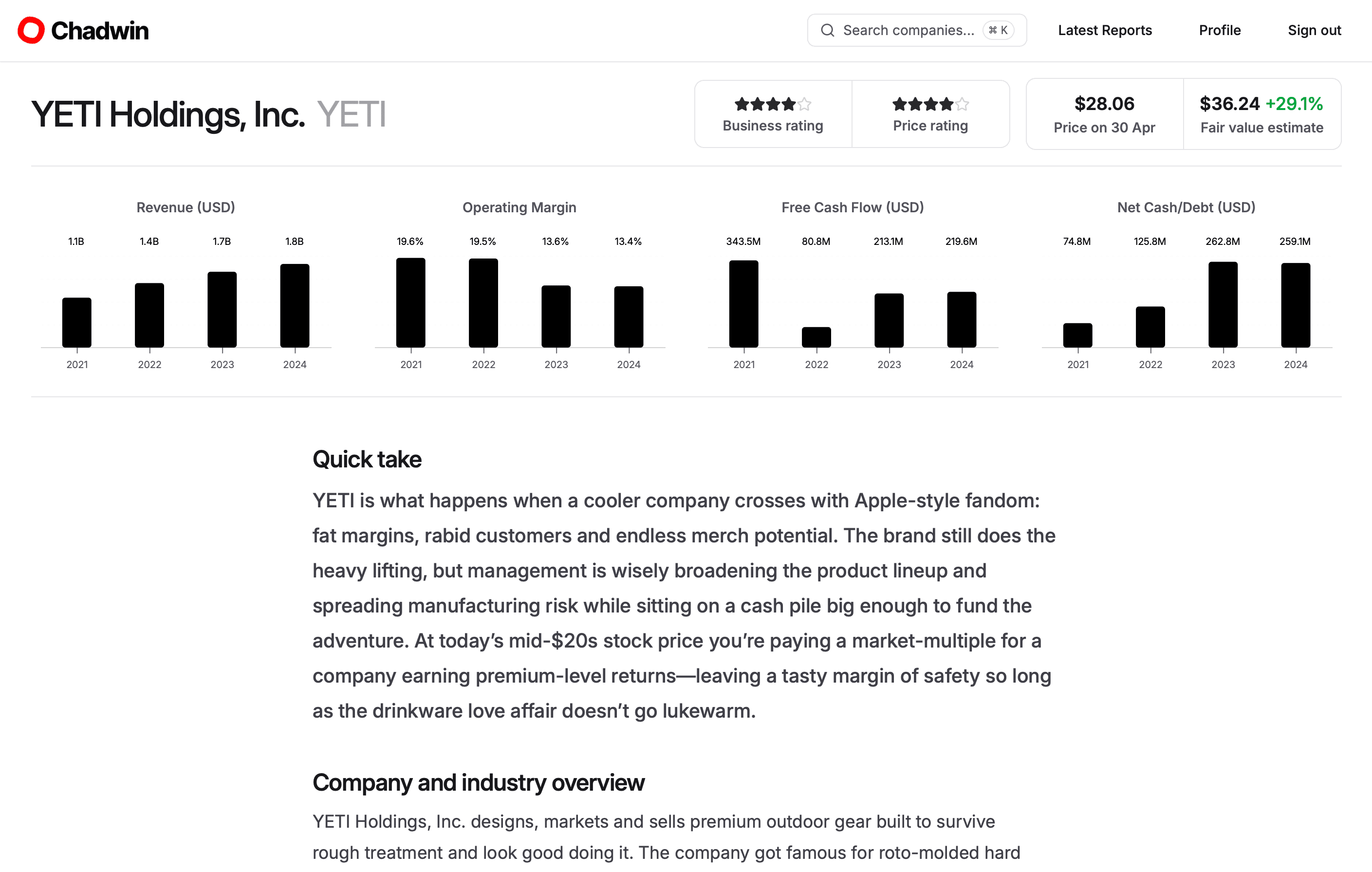

See all financial

data at a glance.

In addition to our comprehensive research reports, we also give you access to 10 years of income statements, balance sheets, and cash flow statements. Put together, this gives you a complete picture of the company, both qualitatively and quantitatively.

Pricing

Standard

- Access to all company reports

- 10 years of financial statements

- Stock price targets

- Business model analysis

- Industry & competitor analysis

- Competitive moat analysis

- Investment thesis